New SEIS Deal: Mind Data - URGENT for end of tax year

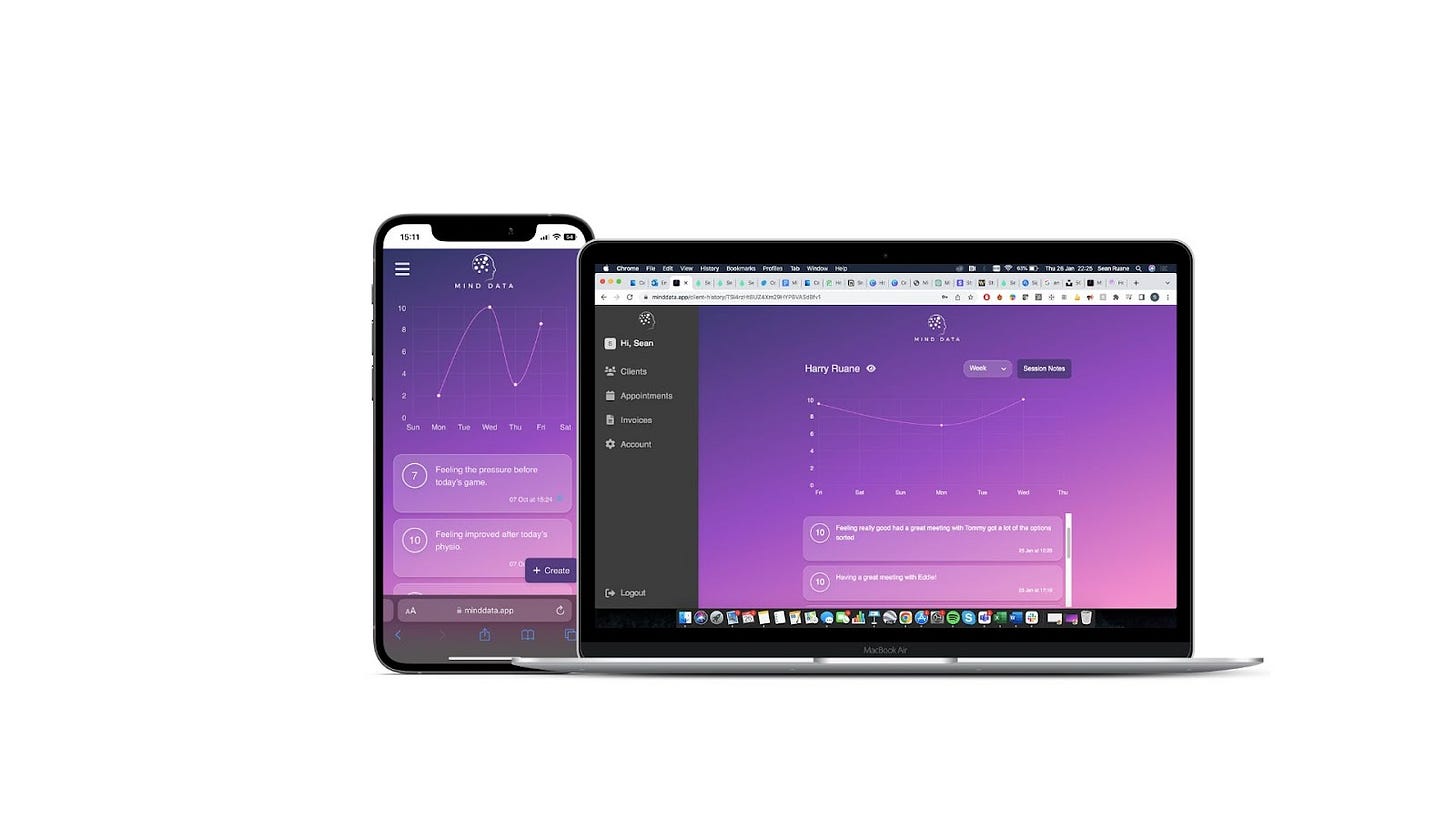

Saas for mental health services, targetted at therapists and organizations

A great concept being driven by an even better founder… Mind Data. THIS DEAL WILL CLOSE END OF THIS WEEK, 26/03.

The below is written by Tom Goodman - MD of Vouch (part of the Goodlord Group) who personally referred and is co-leading the deal.

What we like:

Sean is a first time founder, with a background as a founding team member at a £3M ARR/£27.5M exit HR Tech scale up. Sean’s passion for what he’s building is not just apparent; it’s directly related to his own experiences.

We feel strongly that, although the product and market need to demonstrate viable opportunities for rapid growth, it’s having the right people behind the wheel that ultimately unlock a successful investment and Sean is just that alongside Privacy and Security Veteran, Gian Zambrini and Harvard-trained & best selling author psychologist Dr Helena Kim.

Sean exited Clear Review after 5 years building and then leading their Customer Success team. This has resulted in a customer first approach that recognises commercial gain through obsessing over building relevant products that are in demand. There is a lot of noise entering the mental health space but we love Sean’s minimal viable product approach, leveraging early customer feedback to build tangible and valuable feature development.

This is a pre-seed deal, with funds targeted at marketing to the £190m early addressable market. This go to market strategy is going to be delivered by partnerships with various institutions; to date successful pilots are running with the University of Buckingham, Cambridge football club and the NHS Norfolk.

Potential Outcomes:

Worst Case: Can’t find product market fit. Multiple potential customer demographics, of which the main target demographics are NHS, Educational Institutions and Sports teams, alongside bread and butter therapists, are not adopting and/or willing to pay for Mind Data’s services. Can’t move past proof of concept.

Medium Case: We find a right niche, but it is one of a few (e.g. universities take off but we can’t prove a use case in sports teams) and we realise we are unable to monetise other markets. Equally, we could see that early adopters are supportive but we struggle balancing depth and breadth and end up building tailored products for a few customers, rather than getting wider demographic uptake. We’d likely finish this round with fair levels of adoption across a couple of segments, for example; 5-10 universities and one NHS Trust.

Best Case: Had a number of very successful 9/12 pilots where wider rollout is wanted. NHS in particular is in a position to take case study to other constituencies where we begin national rollout opportunities. We are in a position where demand exceeds resources and we can confidently identify where Mind Data drives the best value and double down on that demographic. This has then delivered confidence in our ability to develop AI solutions into the product which can interpret sentiment and key themes in journals and can feed this back into student counsellors to support what has been seen in the pilots. This puts Mind Data in a position to look at a ~£1 million seed round which will be mainly invested in scale, marketing and product.

Deal summary:

Valuation: £850k pre, £1m post

S/EIS eligible: SEIS pre-approval

Round size: £150k @ 17% equity

Min syndicate commitment: £5k (£1k individual minimum)

Max syndicate commitment: cap of £30k